Thinking about starting a company in Dubai as a foreigner?

Thinking about starting a company in Dubai as a foreigner?

Why you should start a business in Dubai:

Dubai is an attractive destination for entrepreneurs and companies. Here are some reasons why you should consider starting a business in Dubai:

Strategic Location: Dubai's strategic location between Europe, Asia, and Africa makes it an ideal hub for businesses looking to access global markets. The city's world-class infrastructure, including airports, seaports, and transportation networks, facilitates trade and connectivity.

Business-Friendly Environment: Dubai has a pro-business government with policies and regulations that support entrepreneurship and foreign investment. The city offers a range of incentives, including tax exemptions, to attract businesses.

Economic Stability: The UAE, including Dubai, has a stable economy with low inflation and a strong currency. The country's economic diversification efforts have made it resilient to external shocks.

Strong Legal Framework: Dubai has a well-established legal system based on English common law, providing a transparent and predictable business environment.

Access to Talent: Dubai attracts a diverse pool of talent from around the world, thanks to its cosmopolitan environment and high quality of life. Businesses in Dubai can tap into this talent pool to drive innovation and growth.

Quality of Life: Dubai offers a high quality of life with modern amenities, excellent healthcare, education, and recreational facilities. The city's cosmopolitan culture and diverse lifestyle options make it an attractive destination for professionals and families alike.

Tax Benefits: Dubai offers various tax benefits, including no personal income tax and no corporate tax for most businesses operating in free zones.

Economic Zones: Dubai Free Zones VS Offshores

Foreign businesses can consider setting up their companies in two different economic zones - free zones and offshore.

Dubai Free Zones

Free zones are special economic areas where business owners can have a 100% ownership of their company, a 9% corporate taxation (on profits above AED 375,000), and 0% personal income tax. There are a total of 30 free zones in Dubai.

List of free zones in Dubai:

Dubai Airport Free Zone (DAFZA)

International Free Zone Authority(IFZA)

Jebel Ali Free Zone (JAFZA)

Dubai Multi Commodities Centre (DMCC)

Dubai Silicon Oasis (DSO) Meydan Free Zone

Dubai Internet City (DIC)

Dubai Media City (DMC)

Dubai International Financial Centre (DIFC)

Dubai Healthcare City (DHCC)

Dubai South (formerly known as Dubai World Central)

Dubai Knowledge Park (DKP)

Dubai Biotechnology and Research Park (DuBiotech)

Dubai Maritime City (DMC)

Dubai Cars and Automotive Zone (DUCAMZ)

Dubai Design District (d3)

Dubai Science Park (DSP)

Dubai Textile City

International Humanitarian City (IHC)

International Media Production Zone (IMPZ)

Dubai Production City (formerly known as International Media Production Zone or IMPZ)

Dubai Outsource City

Dubai Studio City

Dubai International Academic City (DIAC)

Dubai Techno Park

Dubai Auto Zone

Dubai Flower Centre

Dubai Gold and Diamond Park

Dubai Industrial City

Dubai Wholesale City (Dubai Industrial Park)

Dubai Logistics City (Dubai South Logistics District)

Other benefits of setting up a business in Dubai include customs duty exemptions, capital and profit repatriation, independent laws and regulations, and no extra charges for transfer of funds. Some limitations to note for setting up a company in a free zone are:

The company is not able to expand your business activities to Dubai Mainland, outside of the particular free zone.

Expansion into other UAE markets is also not allowed (for B2C companies).

Limited business activities that can only be based on the specific specialisation of the free zone and its governance.

Higher office rental rates, and limited office spaces in the free zones.

If a free zone company desires to do business in Dubai Mainland, it must acquire licenses and documentation from the Dubai DED, or conduct business in Dubai Mainland through a civil company, a limited liability company, or by establishing a branch office.

Offshore Companies

While offshore companies can be registered in a free zone area and enjoy many of the same benefits as companies in the free zone, it is not an equivalent to a free zone company.

Offshore companies can have business activities outside the UAE, and have no minimum capital that needs to be deposited before incorporation. However, this means that a sponsor for the company is required, reducing your foreign ownership to 49%. It is important to note that some zones do not require a sponsorship, and this includes free zones like DMCC.

Here are some of the benefits setting up an offshore company offers:

Absence of taxes and exemption from double taxation, allowing for flexible financial structuring.

Increased creditworthiness and financial development opportunities.

Simplified sale of shares for quick access to liquid funds, making it a simple form of asset protection.

Both offshore companies and free zone companies have their advantages and disadvantages, so take into consideration your business needs before setting up a company in Dubai.

Types of Operating Licenses

Besides deciding on whether to set up a free zone or an offshore company, you’ll also be required to identify the type of licence needed.

Besides deciding on whether to set up a free zone or an offshore company, you’ll also be required to identify the type of licence needed.

The Department of Economic Development (DED) issues business licenses and there are 3 main types you can apply for:

1. Commercial Licence:

This licence allows for trading activities, import & export, sales, logistics, travel & tourism, and real estate businesses.

2. Industrial Licence:

This licence is suitable for businesses engaged in manufacturing activities like textiles, metal, and paper manufacturing manually or mechanically.

3. Professional Licence:

This licence is for service providers, artisans, and craftsmen such as medical services, beauty salons, and repair services.

Setting up a free zone company in Dubai

1. Find Your Business Activity:

1. Find Your Business Activity:

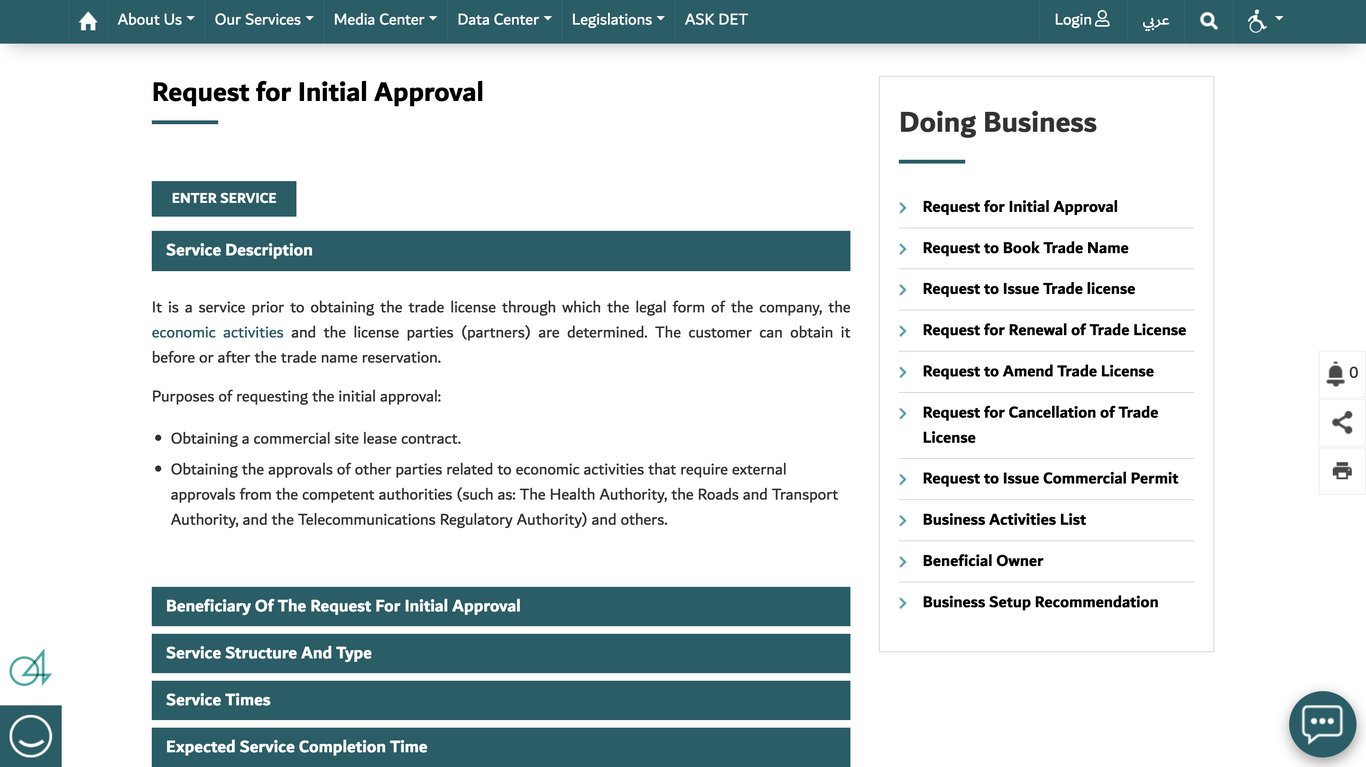

Choose from over 2,100 business activities available, categorized into industrial, commercial, professional, and tourism sectors. The full list is on the DED website. Click on "Request for initial approval", and you will see a "Business Activities List" on the right of the screen.

2. Decide On a Free Zone:

Select a free zone based on proximity to businesses in the same sector and your business requirements. Find out more about the different free zones in Dubai under the Ministry of Economy - UAE site.

3. Choose a Company Name:

Ensure your business name conforms to UAE's naming conventions, avoiding offensive language or references. Reserve your company name here.

4. Apply for Initial Approval:

Obtain the initial approval from the Dubai Department of Economic Development (DED) to start your business in Dubai. The initial approval is a service prior to obtaining the trade license through which the legal form of the company, the economic activities, and the license parties (partners) are determined. The initial approval can be obtained before or after the trade name reservation.

Obtain the initial approval from the Dubai Department of Economic Development (DED) to start your business in Dubai. The initial approval is a service prior to obtaining the trade license through which the legal form of the company, the economic activities, and the license parties (partners) are determined. The initial approval can be obtained before or after the trade name reservation.

Documents needed for the initial approval include: Business registration and licensing form; a copy of your passport or IDA copy of your residence permit/ visa; your company's articles of association; feasibility study of the project. This will be dependant on the nature of your business.

The initial approval allows you to:

Obtain a commercial site lease contract.

Obtain the approvals of other parties related to economic activities that require external approvals from authorities such as The Health Authority, the Roads and Transport Authority, the Telecommunications Regulatory Authority and more

Apply for Initial Approval on the DED website yourself here, or hire a lawyer to help you.

5. Open a Corporate Bank Account:

Once you've obtained the above approval, you need to open a corporate bank account.

Choose from a range of local and international banks to open your corporate bank account. Some banks that you can consider for a corporate bank account include: HSBC, Citibank, Barclays, Abu Dhabi Commercial Bank, Commercial Bank of Dubai.

6. Set Up Your Office Location:

All businesses in Dubai needs to have a physical address. As such, you need to ensure you have a physical address for your business, which can be facilitated by the free zone.

7. Apply For Final Approval:

Prepare all necessary documents, your location addresses, and relevant legal information to submit for final approval.

The necessary documents include:

Initial approval receipt

Lease contract from the Real Estate Regulatory Agency (RERA)

A duly attested service agent contract

Approval from other government entities concerned

Once you are done, you can pay for the license through approved payment channels.

Setting up an Offshore Company in Dubai

1. Choose a Business Structure

Choosing a business structure will determine the paperwork you need to submit, as well as the business management structure. Here are the several business structure options available:

Offshore Foundation: Ideal for non-profit organizations, social clubs, and associations conducting their activities.

Offshore Trust: Used for beneficiary planning, ensuring security, legal protection, and confidentiality.

Limited Liability Company (LLC): A separate legal entity established in a country other than the individual's country of residence, offering liability protection and tax exemption.

International Business Company (IBC): Businesses operating abroad, enjoying tax and duty exemptions.

2. Submission of Required Documents

To start the registration process of your offshore company, you need these documents:

A certified copy of your passport

Copy of the original bank reference or 6 months of bank statements

Utility bill for proof of address

Bank reference letter

CV

Three options for company name reservation (the company name cannot include certain words like insurance, bank, or trust, and must end with "Ltd." or "Incorporated."

Company’s business activity details (including Memorandum of Association (MOA) and Articles of Association (AOA))

This process will take about 4-5 working days, with an express registration option of 48 hours available. The above requirements may vary depending on jurisdiction and free zone, so you have to check with relevant authorities beforehand.

3. Open an Offshore Bank Account

The last step is to open an offshore bank account, which will typically require you to prepare the following documents:

Director's registration

Incorporation certificate

Financial statement

Proof of operating address

Proof of registered address

Shareholder certificate

Do note that the specific requirements may vary depending on the bank and the regulations pertaining to offshore companies in Dubai. In addition, do note that offshore companies can only conduct business outside the UAE, and cannot trade within the local market.

That's all you need to know for setting up a business as a foreigner in Dubai!

This article is brought to you by Bluente.

Bluente is the world’s first business language services platform. We built a document translation tool where you get your translated documents in less than 2 minutes, retaining the same format of your file. Try it now at https://translate.bluente.com. We also we teach business languages (CN, ID, EN, ES) tailored for professionals through our mobile and web app. Find out more here: https://app.bluente.com/home/.